The Obama Economic Plan

Back in the silent movie days, a popular serial involved the escapades of the Keystone Kops. They were a frenetic bunch, but ultimately so incompetent they couldn’t do much of anything. They would run this way and that, stumbling about and generally more successful at running into walls and slipping on banana peels than solving crimes. As a vaudeville act, they were hilarious. As a police force, not so much.

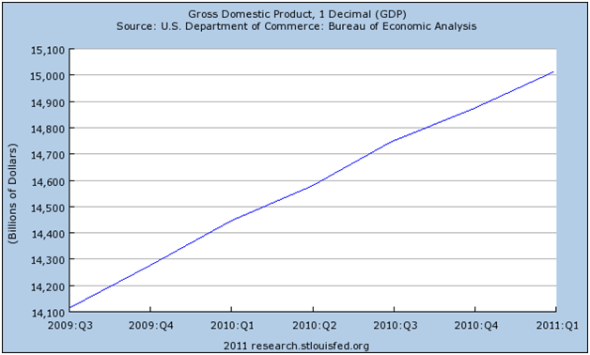

Watching economists from the Keynesian school is a lot like watching those old silent films. They trip over each other in explaining why the economy is moribund and what should be done about it. Never mind that everything in the Keynesian playbook has been tried (and predictably, failed). Fiscal stimulus: over the past 30 months, the federal government has pumped in $2.5 trillion over and above previous spending levels – and GDP is declining after inflation, not growing. Monetary stimulus: the Federal Reserve burned through two rounds of pumping cash into the economy. No growth, but inflation is growing exponentially each quarter. Now the Fed is planning on QE3 – pumping even more cash into an economy that has more cash than can be spent.

Keynesians love to point out that their economic theories are borne out by their successes in the Great Depression. But that assumes that those policies were successful. It seems pretty doubtful that they were. For instance, here in the US, the government did manage to achieve an aggregate GDP growth rate of 9.68% between 1933 and 1940. But in order to achieve that growth, the federal government increased spending by 110% from 1932 levels. In raw numbers, the government spent just shy of $61 billion during those 7 years. But GDP only grew by $47 billion. Remove the government spending, and the economy actually shrank by 26%. That’s a pretty dubious success.

In fact, that’s exactly what happened in 1937: Congress slashed spending, and the economy promptly declined 4.64%. Rather than create sustainable growth, all that government largesse accomplished was an economy that was reliant on government largesse. Entrepreneurship, innovation and efficiency were replaced as keys to success by graft, corruption and political machines. (There was a reason Frank Capra’s Mr. Smith Goes to Washington struck a nerve when released in 1939).

Equally important – and hugely different – from today is the amount of debt headroom FDR had when deciding on a Keynesian approach. In 1932, total federal debt amounted to 51% of GDP. By 1940, that had risen to 71%. In 2008, total debt was already approaching 100% GDP and we’ve since surpassed that.

The liberal wing of politcracy wants a return to full-blown Keynesian economics. If we go down that path, by 2020 the federal government will account for 8 out every 10 dollars spent in the US – but the government will need to borrow 9 out of every 10 dollars it spends.

Maybe our President thinks that kind of vaudeville act is one worth emulating. But I doubt many other Americans agree with him.

I came across an article from

I came across an article from