When Governments Fail

One of my pet peeves – ok, my biggest peeve – is that government doesn’t understand it’s role in society. In particular, one of the overarching themes I find disturbing is how government thinks it knows how best to serve the citizenry. The reality is that government, even when it means well, generally manages to get things wrong. Bureaucrats being bureaucrats, the law of unintended consequences is never taken into account. People’s lives are destroyed in a sort of “collateral damage.”

It doesn’t only happen at the Federal level, where the Great Society ushered in the era of society-killing programs. (Think how many families end up dissolving so the mother can receive food stamps). No, it happens all the way down to the local level. Consider the case of the Lakewood (NJ) “Tent City.” I realize most of you reading this have no idea what I’m talking about, so here’s a little background. In 2006, before the Great Recession hit the nation as a whole, Ocean County experienced a dramatic increase in the homeless population. A largely rural area where the principle economic driver is tourism, there are neither facilities nor public funds available to assist the homeless. The nearest homeless shelter is located in Atlantic City; they don’t have the ability to house people except in the short-term and most of their resources are dedicated to the types of problems found in inner-city homeless populations (things like rampant drug and alcohol abuse, for instance). A local pastor, Steve Brigham of the Lakewood Outreach Ministry, saw a need in his community and took action. With a few tents set up in the woods, the Lakewood Tent City was born. With no public funding, Pastor Steve has established a community that at times has housed as many as 76 people. The rules are simple and direct: no drugs, no alcohol, everyone pitches in and everyone has to be actively looking for work (or working).

Why local government feels the need to get involved in this ministry is still an open question. The tent city is located in the woods and doesn’t infringe on anyone’s property rights. Nor is it located on public parklands or other facilities. The town has attempted several time to evict the campers, with the most recent rejection of their efforts coming earlier today. Their court pleadings have included the usual, such as health and safety concerns. Yet, by all accounts, this hasn’t been an issue at the tent city – as opposed to most of the “Occupy” encampments from this past fall. No, I suspect the real issue here is that a sole individual used a bit of initiative and with a few hundred dollars of private fundraising accomplished something the county said for years it couldn’t: established a viable homeless shelter. No, it’s far from an ideal solution. These are still tents pitched in the woods, without electricity, running water or heat. But it has provided a sense of community and support for those people that would otherwise fall through the cracks.

And I wasn’t kidding about a few hundred dollars in private donations. A perfect example is Heather Skolsky, who became involved after her cousin stayed at the tent city in 2006. (He now lives in New York and works for the Salvation Army). Her first fundraising effort yielded about $300, a few blankets and other supplies. This weekend she’s organized a benefit concert. These are the types of results that government can’t seem to replicate – and remains dedicated to stopping.

So, what can you do? For starters, look around your own communities. Odds are, you’ll find similar organizations in need of help and under assault from local officials. Of course, if you want to help out Pastor Steve in his mission, you can click here to give a donation. If you’re in the Lakewood area, you can always stop by to lend a hand. And if you’re interested in attending the benefit, I’ve included those details below.

The point is this: too often we’ve forgotten the meaning behind JFK’s inaugural address in 1961. While we all remember the words, “Ask not what your country can do for you; ask what you can do for your country,” the reality is that the socialist left still prefers government action to citizen initiatives. In the process, they’ve made programs like the Lakewood Tent City persona non grata in the eyes of the public – even though they create far better results at far less cost than similar government programs. Something to keep in mind the next time someone tells you that government assistance programs are “needed.”

To attend the Lakewood Tent City Benefit tomorrow night:

High Velocity Sports Bar, Rte 166, Beachwood NJ

Doors open 9:30pm. Cash bar, cash donations and/or donations of winter camping gear. For more info, call 732-600-7432 or email Laurens72882@comcast.net

About that Payroll Tax Cut…

Remember when I was begging and pleading with lawmakers to reject President YOYO’S inane payroll tax cut? My worry is that doing so dramatically underfunds Social Security. Well, guess what. Independent analysis is confirming that those worries are justified. Read more at this Washington Post article. My question is, where was this article two weeks ago? Oh, that’s right. The Post, like the rest of the MSM, remains an Obama sycophant.

A Word About Class Warfare

This post began as a reply to a thread on Facebook. Some friends and I were debating the essence of what constitutes class warfare. At one point, one of them reiterated the ageless ism that “class warfare is painting poor people who are struggling as lazy, shiftless and hopeless.”

I do not consider people who do not have as much wealth as I as being lazy, hopeless or shiftless. Some are, but most are indeed, very hard-working individuals. Their great disadvantage is they lack certain talents that I do have. It might simply be that they lack the drive to succeed that I have – I know more than a few people who look at a “work week” as being 40 hours, maybe 50 – but the idea of working 24 hours a day, 7 days a week to make an enterprise successful isn’t what they want from life. And that’s fine, but they shouldn’t expect the same financial results as those of us who do put in that type of time and effort.

I can’t say their circumstances are a result of a lack of education. After all, I never finished grad school but have been more successful in my business career than many of my friends who have MBA’s. And people like Steve Jobs, Steve Wozniak, Bill Gates and other celebrated tech purveyors don’t even have undergrad degrees. This isn’ t to knock formal education. Certainly, for most people a great formal education is a key stepping-stone to career advancement. But given the choice between hiring a Harvard MBA and a kid with no more than a CTIA+ certification and a dream to be the next Woz, I’ll hire the kid. Every time – even though I know he won’t be around long; he’s going places I can’t take him.

I respect what those gentlemen (and hundreds of other entrepreneurs) have accomplished as a reflection of their particular talents, abilities and willingness to take risk. Being successful isn’t a matter of being “fortunate” so much as it is the residue of effort. I think most of us agree on that point (at least, I hope we do). A friend of mine recently launched a taxi company – and he has my ultimate respect. He saw a need, took a chance, made the investments in time, energy and capital and now have something he can call his own. And I’ve no doubt that if he wanted to grow further, expanding his market and footprint, those same qualities would guarantee his success.

Certainly, there are people of great wealth who arrived at their fortunes by dumb luck. Lottery winners, trust fund babies and the like. And if they don’t work hard at maintaining those fortunes, they generally wind up destitute – without any help from anyone. Just think of the stories you read about people blowing a $100 million lottery prize in a few years or the rich kid who partied his inheritance away. Life has an interesting way of dealing with the truly lazy in our society.

Class warfare has been a symptom of our political discourse far longer than the current administration, though this one has embraced it more fully than any since FDR. In fact, what started the entire discussion thread was when I posted this blog post from Ted Leonsis. Leonsis is one of the Obama administrations biggest supporters; he admits maxing his contributions to the Obama campaign. But even this stalwart has had enough with the administration’s bashing anyone with a dollar in their wallet. As Leonsis points out, “Why do we devalue success in the US when the rest of the world is trying to emulate what we have created as an economic system?”.

In the US, we’ve never fully accepted the idea that the general citizenry should pay for their government. Originally, the federal finances would funded by a mix of tariffs and fees, along with specific taxes placed on interstate commerce. By the dawn of the 20th Century, populists such as William Jennings Bryant and Theodore Roosevelt were agitating for a more expansive role for the federal government. Then, as now, there was a general hue and cry against men of wealth and the political ethos of the day demanded a “progressive” tax system. The original formulation was such a drastic change from the nation’s founding ideals that it required the 16th amendment to the Constitution. Prior to then, taxes levied directly on the citizenry had to be apportioned according to the most recent census. The charge among progressives was that the existing system was regressive – in that everyone had to pay the same share. They first attempted to circumvent this by passing a progressive income tax in 1894, the Supreme Court (in Pollock) ruled it unconstitutional in 1895.

There is a perception that those of us with means are opposed to paying taxes. We don’t enjoy paying them (nobody I’ve ever met actually does), but we understand that some government is a necessary evil. To that extent, we realize somebody has to pay for it and in a republic, it falls on the citizens to ensure the government is funded properly. If taxation were truly fair and equitable, there would undoubtedly be less grousing. However, there are two issues that have been brought to the fore with the recent debate (and devolution into class warfare) but not addressed:

First, those of us with means are not in the habit of tossing our money down the sewer in the vain hope that it eventually comes out the drain. We’re accustomed to being able to get a full accounting of where our money is, what it’s doing and when it’s doing it. (Well, most of us, anyway. There are always Bernie Madoff types). Our current budget morass lends itself to no such accounting. In fact, quite the opposite. As just the most recent example, consider the recent flap over FEMA funding. Once it became apparent that the government was about to shut down over the relatively small pittance, the administration suddenly “found” $780 million of funding that they had misplaced. The same thing happened over the summer, when the deficit mysteriously shrunk by $400 million. When you are a nation that is taking in 20-23% of national income as taxes, it is only fair to ask where the heck all of that money is going before asking anyone for more.

Secondly, we constantly hear the refrain that “the rich don’t pay their fair share.” I’m not quite sure what that refers to, but when nearly 1/2 of the nation doesn’t pay any income tax – and the bottom 1/5 receive more in federal benefits than they pay through any form of taxation – it seems that the rich are certainly paying at least their fair share. The greatest share of the tax burden is well-known by now, but in case you missed it – the top 10% of all earners (which begins with a family of 4 earning $114,000) pay 70% of all taxes. Not just income taxes, but all federal revenues. Those in the 11 – 50% bracket provide 22.3% of the nation’s revenue. So, once again, who isn’t paying their fair share?

What class warfare of this type does is inflame passions. The only reason the “progressive” wing of American politics uses it is for one reason: to shake us down, so that they can grow government even further. If you don’t think so, then consider this. In 1937, at the height of FDR’s New Deal, the federal government consumed 16% of total GDP. In 1970, as LBJ’s “Great Society” took hold, that increased to 31%. Last year, it rose to the highest peacetime level ever at 39.55%. Now ask yourselves: Is the government really doing anything in 2011 that it didn’t do in 1937? And then ask yourselves why.

When you arrive at the answer, you’ll understand why the Obama Administration is resorting to class warfare and striving to divide us as a nation.

So Much For That

President Obama’s “Son of Stimulus” (aka the American Jobs Act) is already dying the slow, tortuous death of a thousand paper cuts. And for good reason: the majority of Americans don’t buy the President’s latest smoke-and-mirrors plan. After all, stimulus was tried in 2009 and failed miserably. We were assured that spending nearly $800 billion in direct stimulus, plus billions more for “cash-for clunkers,” the automotive industry bailouts and banking industry bailouts would curb unemployment to 8% and have us under 7% by this point. More telling than the fact that was a terrible overshoot, is that nobody in the administration is willing to put any kind of number on how many jobs this latest round of stimulus would create. I doubt anyone in the White House actually believes this would really do much for the economy.

President Obama’s “Son of Stimulus” (aka the American Jobs Act) is already dying the slow, tortuous death of a thousand paper cuts. And for good reason: the majority of Americans don’t buy the President’s latest smoke-and-mirrors plan. After all, stimulus was tried in 2009 and failed miserably. We were assured that spending nearly $800 billion in direct stimulus, plus billions more for “cash-for clunkers,” the automotive industry bailouts and banking industry bailouts would curb unemployment to 8% and have us under 7% by this point. More telling than the fact that was a terrible overshoot, is that nobody in the administration is willing to put any kind of number on how many jobs this latest round of stimulus would create. I doubt anyone in the White House actually believes this would really do much for the economy.

Americans intuitively understand that stimulus spending doesn’t really do much, except exacerbate the underlying cause of our economic malaise. Economists will tell you that the reason we’re in such a mess is because consumer demand – which fuels around 70% of total economic activity – is depressed. If only that were true.

The real cause for depressed sales is much more basic: people can no longer afford to buy consumer goods. They still want iPads®, flat-screen TV’s and new cell phones. But when they sit down with their bills each month, they aren’t willing to incur new debt to purchase them. After all, the debt frenzy that drove the last 20 years of economic growth met its inevitable end with the financial collapse of 2008. We’re still busy digging our way out from that mess and until the typical household reduces their debt burden, don’t expect them to begin spending again.

The same goes for government. The massive expansion of federal debt leaves Americans feeling equally queasy – after all, we just learned a valuable lesson about what happens when people and companies are over-leveraged. When public debt exceeds the total value of the economy and projected spending continues to go up, not down… Well, let’s just say we aren’t interested in finding out if an over-leveraged government can suffer the same fate as an over-leveraged household.

Death Spiral Debt Deal

As I’m sure we’re all aware, the major political players in Washington agreed to debt ceiling deal last night. Reuters has a terrific breakdown of the final deal here. I’m not happy with this “deal” at all and if I were in Congress, would certainly vote “No” on passage.

Why? Simply put, this agreement does absolutely nothing about either the current deficit or the even larger problem of the national debt. In fact, passage guarantees that the debt will double over the next decade. And just for grins and giggles, there are also some really rosy ideas about anticipated economic growth baked into the framework – ideas that in light of last week’s GDP reports are proven to be a complete sham.

Let’s start with the sham of an idea that this deal somehow trims the deficit. The only guaranteed cuts in the whole package are for FY2012 – and they total all of $6 billion. Even if you use the overly-optimistic CBO estimate of “only” a $1.049 trillion deficit for FY2012, that amounts to about ½ of 1% of the deficit. To put this in perspective, it’s the equivalent of the average American cutting their total annual spending by $37.85, or the typical price for a dinner for two. This is every bit a dog-and-pony show, not budget cutting.

Secondly, this deal does little to curb long term spending, either. The final total of $2.4 trillion takes place over the remaining 9 years. However, the combined deficits over the next decade are forecast to equal another $13 trillion. That would bring the national debt to a total of around $28 trillion by 2020. Even if future Congresses don’t reduce that $2.4 trillion in deficit reduction (good luck with that), the federal debt will amount to $25.6 trillion in 2020. This package doesn’t do anything to actually begin reducing the debt. Only in Washington could a package that will grow the federal government’s debt obligation by 77% be considered a “debt-reduction plan.”

Finally, there’s the kabuki-theater method of arranging these “cuts.” Part of the reduction comes from presupposing that the Pentagon can find $350 billion in cost savings as a result of the wars in Iraq and Afghanistan ending. The deal-makers completely ignored the fact that we recently got involved in another war in Libya and also imagine that we won’t get involved in any others before 2020. I would like to go on record now as believing in the tooth fairy and unicorns, since those are less farfetched assumptions. There is a “super committee” that’s supposed to recommend budget cuts on a straight up-or-down vote; failing that, across the board reductions in all government programs. Well, almost all – federal employee pay, Medicaid, Social Security, welfare and veteran’s benefits are excluded. Considering we’ve already had 16 deficit committees in the past 20 years, each of which has said that the principle way to reduce the debt is to transform entitlement programs – and this deal exempts most of them from automatic cuts – how successful do you suppose this one will be? Expect another political dog-and-pony show, only this one should be a spectacle that would make PT Barnum proud. After all, it’s taking place during an election year. The posturing and grandstanding over recommendations that have no chance of passing both Congressional houses will liven up campaign ads and the evening news, but mean nothing.

So, no, I can’t support this deal. It just lends further proof that Washington is run by inept morons and snake-oil salesmen.

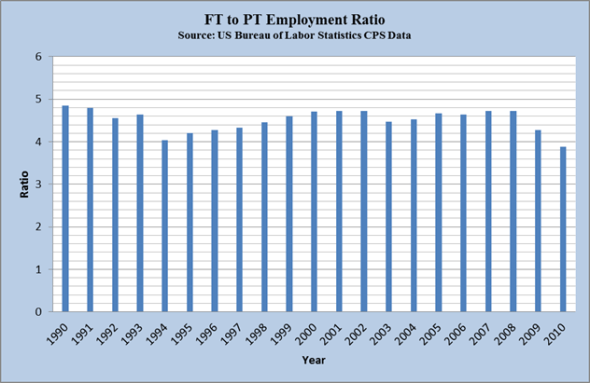

Whither the Recovery?

For an economy in recovery, depressing economic news is all around us, it seems. In the past few weeks we’ve been told our home values have declined to 2002 levels. Unemployment ticked up to an official 9.1%, although the majority of non-governmental analysts tell us the real unemployment number is closer to twice that. More Americans are losing their jobs, as 7 of the past 9 weeks have seen new unemployment claims exceeding 400,000. For the fortunate few who are able to find work, they are winding up in the McJob industries. Of the 54,000 jobs created in May, 62,000 were actually McDonald’s hires.

You do the math: McDonald’s hired 62,000. Take away those menial, low-paying, no benefit jobs and the economy actually lost 8,000 jobs. For anyone aspiring to middle class, a McDonald’s job is not exactly high on the career path, either.

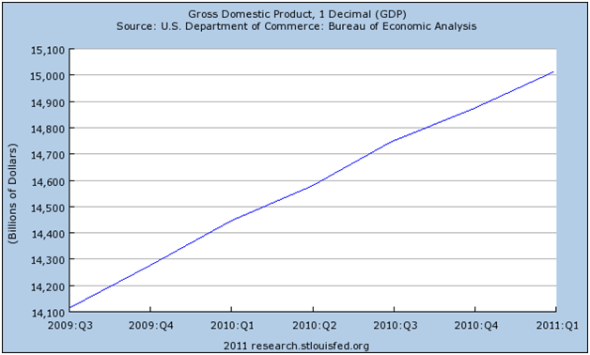

We’re told that economic growth has been muted. The truth is, there hasn’t been any real economic growth during the Obama administration. What we’ve experienced is a decline in the rate of recession. In other words, we’re still in an economic slump, it’s just not as bad as it was at the end of 2008. Let me explain, using the charts below. First, is quarterly GDP or the net worth of all goods and services produced:

Yes, that’s right. In the 6 quarters the US economy has been recovering, the net gain in GDP amounts to $900 billion. Under the technical definition of a recovery, even this paltry real rate of growth (about 1% per quarter) qualifies. Yet, inflation over that period remained higher than the growth in GDP. Mind you, these are the Fed’s own numbers:

Why is this notable? If inflation is growing faster than the value of goods and services, then GDP growth has come as a direct result from inflation. In fact, if you readjusted GDP growth to account for inflation, you get this:

And if you look at the growth curve over this same period, you get the dreaded upside-down smiley face:

We’ve never actually any real growth, despite what the spinmeisters in Washington would have you believe. When accounting for the effects of inflationary fiscal policy by both the government and the Federal Reserve, the best the economy has managed is two quarters without decline. The next time you find yourself wondering where the “recovery” is and why it’s left you behind, don’t feel so bad.

There never was one.

Why is Everyone Afraid of the Debt Ceiling?

One of the things we keep hearing from “establishment” politicians, economists and others is that the US entered into the Great Abyss yesterday afternoon. “The sky is falling” they cry. “We’re doomed” they yell.

This guy is broke - and so are you!

You see, the United States of America just crossed the Rubicon. The debt ceiling – the amount of debt Congress authorizes the Treasury to accumulate – has been reached. The great fear is that the US government is about to default on our public debt, sending the world into an economic vortex never before witnessed. Every talking head and government official in DC is warning against not raising the debt ceiling. “We’ve never defaulted on our debt” is the common cry of alarm.

I would certainly be alarmed at this outcry, except for one thing. It isn’t true. Not a single word of it. In fact, the nation has defaulted on the debt at least twice in our history. The first was in 1790, when we couldn’t service the debt we accrued during the Revolutionary War, among other things. The second was in 1933.

In 1790, the Treasury realized it could not possibly repay the outstanding loans the Federal government assumed after the ratification of the Constitution. The solution was to unilaterally rewrite the terms of those loans, reducing the interest owed and deferring payments for ten years.

The scenario most applicable to today is the one enacted by FDR in 1933. The government, faced with a debt it could not repay unless taxes were raised to incomprehensible levels and wanting to inject some life (i.e, capital) into a lackluster economy, devalued the dollar by more than 40%. The problem was that US bonds were issued in gold: you bought x amount of bonds in dollars and in return you received y amount of gold when the bond matured. The US didn’t own enough gold to cover the debt. The solution was Executive Order 6102, later codified as the Gold Reserve Act of 1934. It essentially confiscated all of the private gold holdings in the US (private citizens were allowed to have 5 troy ounces in their possession; or about $7500 worth in today’s standards).

The exact opposite of what we’ve been told by economists and politicians of all stripes happened: rather than market chaos and depression, the economy stabilized. Freed of the uncertainty spawned from over-indebtedness, the business community actually began expanding again. Yes, the Great Depression was so deep that it took additional government spending to make up for the slack in employment. But contrary to popular myth, it wasn’t the massive infusion of government capital with the outbreak of WWII that jolted the US to full productivity. By 1939, the nation’s economy was growing at 1928 levels again and by the end of 1940 had grown private sector employment to higher numbers than at the outset of the Great Depression. In fact, all of that debt from 1941-1945 precipitated a debt crisis in 1946 comparable to the one we’re now facing. Oh, and Congress took the appropriate actions then, too: they enacted a debt reduction plan that was adhered to by Presidents of both parties until LBJ’s “Great Society” spending in 1967.

Simply put: the US has defaulted on debt obligations before and the world went on as always. Look around you: the debt limit has passed, yet everything continues as on Monday. The real threat is that we continue to spend as profligately as a drunk sailor without any plan to tackle the debt. We can argue about the means to do so. We can inflate it away, as Russia, Argentina, Brazil – and the US in 1933 – did; we can unilaterally reorganize bond terms, as in 1790. We can reserve a greater share of federal revenues for debt service, as in 1946. We can even place tax increases and restructuring on the table. But scaring the citizenry about the implications of failing to to raise the debt ceiling is ludicrous, when raising the the ceiling is the most irresponsible thing the politicians now in Washington can do.

Economic Revival: Fact or Fiction?

This article appeared in yesterday’s edition of Forbes. The authors, economists employed by First Trust Advisors, postulate that the economy is in recovery is underway. The only thing holding us back is unwarranted pessimism.

Phil Gramm’s thoughts on the economy have come back, it seems. You remember Gramm – during the 2008 election, he spouted off that the only thing wrong with the economy was the public’s perception. Shortly thereafter, Gramm joined the long unemployment line that was merely a figment of his imagination.

The indicators they point to, such as the increasing trade imbalance and devalued housing stock, are rife with the reasons the economy is in such a mess. Once again, we have economists pointing to debt-fueled consumption as the way to end the current economic slump. Nobody in their right mind is going to increase their debt load in this climate and for good reason. Basic common sense; the type of common sense missing from many economists and politicians psyches, tells us that we cannot borrow our way to prosperity any longer. Yet these types of articles continue to be published and their views continue to corrupt our discourse.

What is needed to get the economy rolling again is demand. The right type of demand, fueled by sustainable methods of production and innovation, not by gimmicks derived from debt restructuring, is the surest way to sustainable growth. So how do we get there – and remove the parasites who feed on debt?

We start by demanding government remove the binders on innovation and consumption. By continually bailing out mismanaged companies and decrepit industries, governments are preventing new industries and companies from establishing roots and flourishing. Regardless of the political unsavoriness that allowing large companies to fail and industries to wither presents, the process of “creative destruction” is essential to a growing and vibrant economy. The same way you prune dead shoots from a rose bush to allow larger blooms to grow is the same way the government should approach handling the economy.

Pursuing such a policy will cause employment displacement – but government officials can hardly claim the policy of propping up failed businesses hasn’t resulted in the same (nearly 1M newly unemployed this month can attest to that). This is where the government can assert a positive force, by providing short-term financial assistance to those displaced by the new economy. Likewise, government can fuel new growth by ensuring those displaced receive the training they need to compete.

Unfortunately, we’ve already wasted more than $1T in bailing out failed industries, leaving a huge debt sinkhole without anything to show for it. Instead of prudent financial management, it looks like our leaders – enamored with, and products of, the culture of debt – consigned the nation to a long period of economic malaise. While the second half of the program outlined above was made infeasible by the debt policies pursued by the federal government, the first half can be attained. The economic pain will not be any worse than what the nation currently feels. But given an intransigent White House and bickering Congress, it doesn’t seem likely they will change course.

The Fed Announces It’s Time to Panic

It isn’t often that the political right and left in this country agree on anything, but if two articles I read this morning are any indication, we may have finally found common ground on the issue of the stagnated economy. More significantly, articles in Forbes and The Huffington Post are both sounding the same alarm bells about the Fed’s actions yesterday. If there are two publications more diametrically opposed in terms of editorial slant, I can’t think of them. After all, on most issues the Huffington Post is slightly to the left of Fidel Castro and Forbes founder (and namesake) is the epitome of neo-conservatism.

What the Fed did yesterday is press the panic button. I’m sure the President and congressional Democrats can’t be too happy about that – after all, various administration members have assiduously assured us that the economy is all fine and those of us complaining are simply making mountains out of molehills. The Fed (or more accurately, the Federal Reserve Board of Governors) said, “Um, maybe not. The economy is slowing and we’re headed for a second recession.” As their statement said,

“Information received since the Federal Open Market Committee met in June indicates that the pace of recovery in output and employment has slowed in recent months…investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls…the pace of economic recovery is likely to be more modest in the near term than had been anticipated.”

In case your wondering, when the Fed uses terms like “slower than anticipated,” that is simply a banker’s way of saying that things are really, really bad. How bad? In the January 2010 report, the “anticipated growth rate for GDP” was 2.8% – 3.2%. If you prefer, the Fed was anticipating anemic growth already – if they’re now saying the actual rate of growth is even less than that, then it’s safe to say we’re approaching negative growth. If the economy was shedding jobs during a period of supposed growth (albeit anemic growth), what happens when growth turns negative?

Thus, the Fed is panicking. That is, nine of the ten members of the Board of Governors are panicking. (I’ll get back to the tenth in a moment). It’s perfectly understandable, since the only thing that can make a banker afraid more than a lack of government bailouts is the thought of angry mobs demanding their deposits. The actions the Fed took yesterday – converting the sizable investment in mortgage bonds they currently hold into treasuries and keeping the funds rate near 0% – indicate an organization that is under the misled belief that there isn’t enough money in the economy today.

The nine members who voted for these policies ignored a huge source of money that is available, but lacks the impetus to spend. As has been widely reported, corporations are sitting on approximately $1.8 trillion in cash assets. That equals about 12% of estimated GDP for this year – or nearly double the economic “stimulus” spent by the federal government since 2008. Those huge cash reserves, if invested back in the economy, would represent the most effective stimulus possible, since those funds would be directly spent on investment, including capital expenditures and employment. But by depressing interest rates, the Fed is holding down any incentive for businesses to invest.

This point was brought up by Thomas Hoenig, the one member of the Fed Board who didn’t vote to hit the panic button. (Told you I’d get back to him). In a nutshell, Hoenig is worried that by depressing interest rates while pumping more money into the economy, all the Fed is accomplishing is creating another bubble. Nobody is prescient enough to tell you what industry that bubble will encompass (my guess is health care), but it’s certain to come. As Hoenig pointed out, in 2003 the Fed took similar actions – and gave us the housing bubble, which led to the current recession. In 1997, the Fed took similar actions – and gave us the tech bubble.

It can be argued, and perhaps rightly, that the Fed’s overzealousness in 1997 and 2003 was warranted, since monetary policy was the best option for jump-starting stagnating economies. There is a major difference this time around, and that difference is the vast cash reserves companies have built up during this recession. The Fed’s current monetary policy is a huge disincentive for those companies to invest in what are typically long-term assets with high immediate and near-term costs; namely people and equipment. How? First, by limiting inflationary pressures, there is no reason to invest cash into something that will lose value in the near-term. Once inflation does kick in (and it will; the amount of money currently floating around plus artificially depressed interest rates guarantees it), every dollar invested now loses value not only through depreciation but also in the natural devaluation that comes with inflation. (If inflation were held at the Fed’s target rate of 5%, a dollar today would only be worth 95 cents next year). It makes much more sense, from a business perspective, to invest that money into something that almost certainly will appreciate in value. It is the mindset that explains the stock market’s insane gains this year.

So what should the Fed do? I argue the Fed should look for ways to take money out of the economy – raising interest rates and selling those securities it purchased over the past 2 1/2 years. By thus shrinking the money supply, those business currently hoarding cash are forced to begin spending again. Why? Cash flow is the lifeblood of business. Right now, business can ignore normal consumer markets because they’re making huge profits by investing their capital in the stock market, in many cases buying back their own stock and driving the prices up, ensuring positive cash flow. Once the excess cash is removed from the economy, the financial markets will react as they always do to inflation: prices will drop and indices will decline, drying up the current avenue for establishing business income. Those same inflationary pressures will force businesses to reconsider investing in long-term capital – investing their cash before its purchasing power declines.

Unfortunately, the Ben Bernanke’s and other Greenspan disciples (including the Treasury secretary) are not of a mind to engage in this type of monetary policy, fearing that jump-starting the economy by raising inflation will result in the type of over-inflation from the 1970’s and wind up uncontrollable. Oddly, many left thinking economists (notably Paul Krugman) are like-minded, although they prefer government spending over monetary policy to pump more cash into the economy. Either way, I can’t help but wonder if they’re seeing the same economic landscape those of us in the real world see. Oh, and if they realize that the policies of “priming the pump” we’ve pursued for the past 2 years haven’t worked and may very well have pushed the real economy off the cliff.

My biggest fear is they don’t see it – and they’ve taken the very social order of the first world with them in their mad dash chasing after rainbows.

Joe Fed Makes Twice What You Do (and for Doing 1/2 the Work)

More depressing news from Washington. According to this article in USA today, if you work for the federal government you’ll earn; er, make about twice as much as if you worked in the real world.

I did some back of the napkin calculations to see how much money that wastes in a year, even assuming we need all of those federal workers. (I don’t think we do, but until we get the private sector hiring again, leave ’em where they are). The number is…staggering. This is based on the average fed worker receiving $121K in annual compensation, the number specified in the article.

(Number of federal employees x $121,000) / 2=estimated overpayments

(2,150,000 x $121,000) / 2 = $130,075,000,000.

That is 130 billion, 75 million dollars.

Or, as my dear departed Granddad would say, “that’s a shitload of samoleans!” (I never really found out what a “samolean” was, but I always assumed it was something mean that traveled in big packs – like government employees).

I don’t know about you, but if the Keynesians want to spend some government dough around, I’d suggest they have a way to pay for it without adding to the debt. Simply tell all those federal employees they’re getting a 50% reduction in pay. It would also accomplish something else: all those beauracrats would actually begin to understand what it’s like to take drastic pay-cuts, only to see your job disappear 6 months later.

We can only hope…

Time for a New Consensus

One thing is becoming painfully obvious: the way we, as Americans, view economic opportunity is out of step with the way the world operates today. It is time that we recognize this and address it in a positive manner, without the political fire-bombing that is hurled daily on both the left and the right.

The left is stuck with an early 20th century Keyensian view of economics. I’d argue that particular view didn’t really work then and won’t work today. Massive infusions of government capital during the 1930’s into public works projects did build some marvelous edifices, such as the Hoover Dam, but did not absolutely nothing to end the Great Depression. America didn’t return to full employment until the advent of World War 2 – the result of increased war production and more than 10 million men entering military service. Once the war ended, the economy again returned to near-Depression era levels of unemployment. What finally proved the cure for the economic ills of the 1st half of the 20th century was that in the post-war period, only the US remained capable of providing the goods and services needed by the world. It was an export economy, fueled by international demand, which put America back to work.

The right seems permanently wed to supply-side economics. Strict adherence to that model might have worked, but we’ll never know. While government receipts during the supply-side era (1981-2008) outpaced inflation by (See fig. 1), government spending at all levels increased at an even more dramatic pace, leaving us with unsustainable levels of debt and continuing government deficits – and a seemingly insatiable public demand for services that we cannot afford.

The current model being followed is a strange amalgam of the two diametrically opposed economic philosophies, with government interventions and expanded spending coupled with “targeted” tax breaks. In one sense, this new model has worked: businesses are sitting on a virtual mountain of cash. But in a much larger sense, these haven’t worked to stoke the economy – and for one simple reason, the demand needed by businesses to invest that capital doesn’t exist now. Employment data continues to remain bleak, representative of the fact that businesses are not investing in human capital. Part of the reason is undoubtedly tied to regulatory uncertainty, since anyone running a business needs to properly plan and account for the funds allocated for human resources. But that uncertainty alone cannot account for the downward pressure July’s economic data displayed on employment.

What is needed is recognition by both those on the right and the left that a new demand model is required for our current age. Modern technologies have made many labor-intensive occupations of the late 20th century redundant. Cloud computing and SaaS technology reduce the need for office and technical staffing, closing off two of the high-growth industries of the past 30 years. Manufacturing tasks that once required dozens of people can now be fully automated, with only one operator required. (Just last night I watched a documentary on Zippo lighters – the entire assembly line only needs 5 people to run it; a perfect example). Even many low-wage jobs have been replaced – the other day I went food shopping. No cashiers were available; the entire checkout line was self-service with two people running 20 checkout lanes.

In other words, there are two possibilities now facing the country:

- Current unemployment levels are now the “new normal” and a return to sub-5% unemployment is unlikely. In this event, the current social services are inadequate and need serious revamping. Unemployment insurance as currently exists needs to be discarded, replaced by a system that is more proactive in returning the unemployable to the workforce while ensuring that people are not discarded like yesterdays news. Such a program needs to be structured so that chronic unemployment and other abuses are not permitted. In short, in such a world, unemployment services should not be a state duty, they should very much be a federal-corporate symbiosis. It is impossible – and against a state’s interests – to train somebody for employment opportunities in another state, but it is in a company’s best interest to do so.

- Current unemployment levels are an aberration; a temporary result of career displacement due to a technology upheaval. Such upheavals have occurred before and the nation weathered those storms, most recently in the late-1970’s as the nation shifted from a manufacturing base to a services based economy. In this case, the government needn’t do much of anything, except make career retraining available and mandatory, in order to continue receiving unemployment insurance payments. Once, that is, the new employment needs are identified.

I’m not going to pretend I’m smart enough to know which of the two scenarios is correct. What I do know is that until we begin to honestly discuss them, no action can be planned or undertaken. But as I mentioned at the top of this post, neither side seems ready to abandon decades-old dogma. I doubt either will over the next 90 days, as we begin a new national election cycle and both sides seem to only care about scoring political points by feeding raw meat to their adherents.

It’s up to the American people to put aside our natural inclination to fear in uncertain times and force our political leaders to engage in an honest discussion of the situation. And if they won’t?

Then it’s up to us to replace them this November with people who will.